Voyager Loan Wallet: Navigating Crypto Lending's Complexities

Table of Contents

- Understanding the Digital Wallet Ecosystem

- Voyager Digital: A Glimpse into its Lending Model

- The Mechanics of a Voyager Loan

- Transaction Speeds and Operational Realities

- The Collapse: When a Wallet Voyager Loan Turned Sour

- Navigating the Aftermath: Tax Implications and Recovery

- Lessons Learned from the Voyager Experience

- Future of Crypto Lending and Wallet Security

Understanding the Digital Wallet Ecosystem

Before diving specifically into the "wallet voyager loan" experience, it's essential to grasp the broader concept of digital wallets and their evolution. Our everyday lives are increasingly intertwined with digital solutions for managing finances and access.The Evolution of Wallets: From Physical to Digital

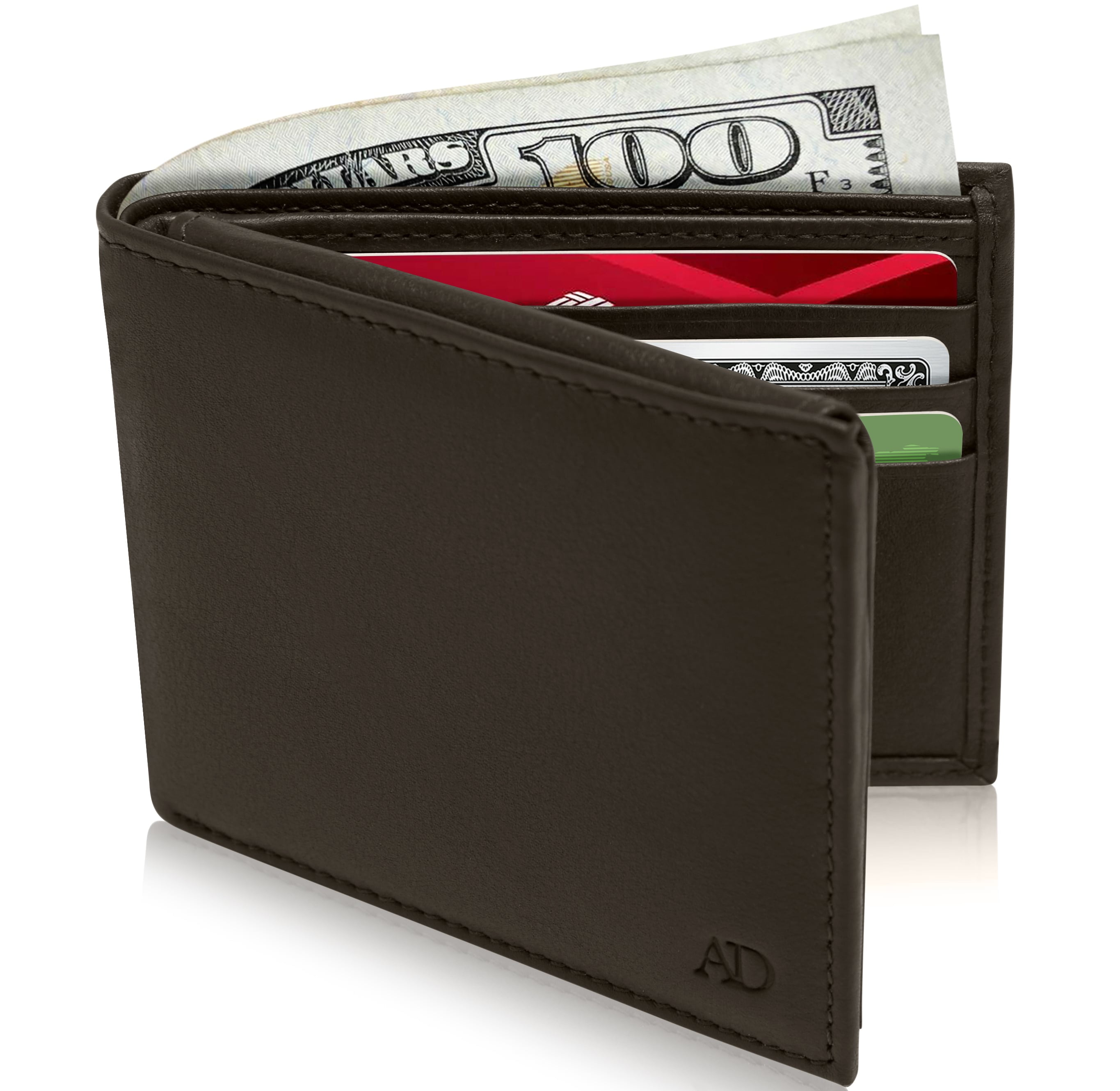

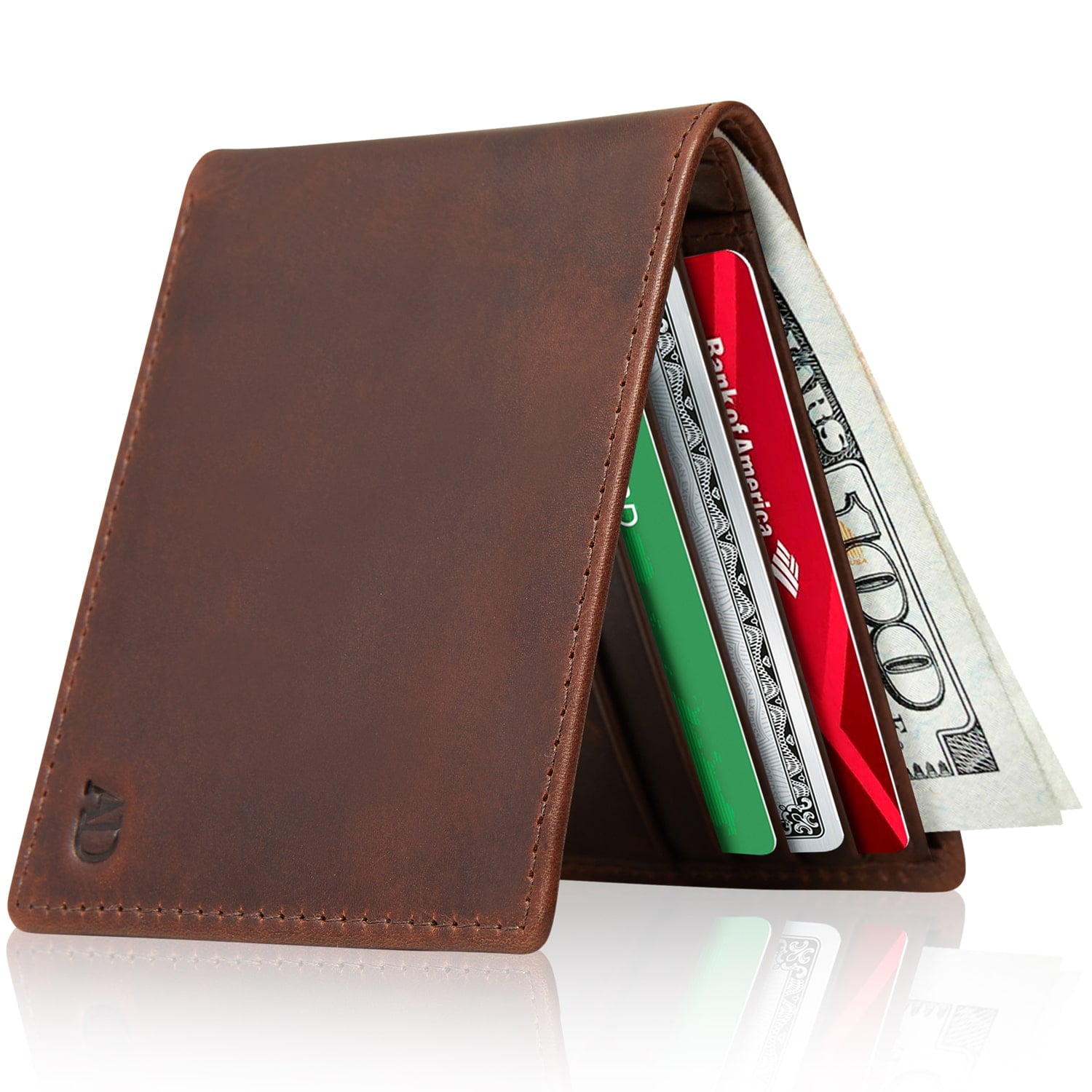

The concept of a "wallet" has undergone a significant transformation. Traditionally, a wallet was a physical item – a leather bifold or a slim card holder – designed to hold cash, cards, and perhaps a few important notes. We've seen a wide selection of women's wallets at Amazon.com, offering free shipping and returns, and men's wallets and card cases at Nordstrom.com, featuring top brands like Tumi, Burberry, and Coach. Brands like Bellroy craft slim leather wallets, zip wallets, and card holders for everyone, emphasizing premium materials that feel great and age beautifully. The Ridge, for instance, crafts products made to last a lifetime with simple, functional designs ready for anything and everything. These physical wallets are about securing your keys with ease and carrying your essentials. However, the digital age has introduced a new paradigm. Google Wallet, for example, gives you fast, secure access to your everyday essentials. You can take the train, tap to pay in stores, and more with your digital wallet. This shift from physical to digital convenience has paved the way for specialized digital wallets, including those designed for cryptocurrencies. Just as you might shop Target for wallets you will love at great low prices, choosing from same-day delivery or order pickup, the convenience of digital access has become a key driver. From a genuine leather wallet that matches your favorite handbag to standout pieces that get noticed for all the right reasons, the appeal of a well-designed wallet, whether physical or digital, remains.The Role of Centralized Platforms in Crypto Wallets

In the cryptocurrency space, a "wallet" can refer to several things. It can be a hardware device (cold wallet) that keeps your private keys offline, or a software application (hot wallet) connected to the internet. Centralized cryptocurrency exchanges and platforms, like Voyager, offered users what is known as a "hosted hot wallet." This meant that when you created an account with Voyager, you would automatically receive access to a hosted hot wallet within their system. The convenience was undeniable: you could easily buy, sell, and store various cryptocurrencies directly within the Voyager app. However, a critical distinction, often overlooked by new users, was that while you could leave your crypto in your Voyager app, Voyager held the private keys to your crypto. This fundamental difference – known as custodial vs. non-custodial – meant that users did not have direct control over their assets in the same way they would with a self-managed wallet where they held their own private keys. This custodial model was central to how Voyager could offer services like lending and borrowing, but it also introduced counterparty risk, as users were reliant on Voyager's solvency and operational integrity.Voyager Digital: A Glimpse into its Lending Model

Voyager Digital positioned itself as a crypto-asset broker that aimed to provide an intuitive and user-friendly experience for trading and managing digital assets. Beyond just trading, a significant draw for many users was the opportunity to earn interest on their cryptocurrency holdings, effectively participating in a "wallet voyager loan" ecosystem. Users would deposit their crypto into Voyager's platform, and Voyager would then lend out these assets to institutional borrowers, paying users a portion of the interest earned. The platform's native token, VGX (Voyager), played a role in this ecosystem. With a circulating supply of 222,295,208 and no current plans of issuing more tokens, VGX could be used to reward users within the Voyager ecosystem, potentially offering higher interest rates or other benefits, further incentivizing users to keep their assets on the platform. This model, while attractive due to seemingly high yields, operated on principles similar to traditional finance where banks lend out customer deposits. However, unlike traditional banks, crypto lending platforms lacked the robust regulatory oversight and protections, such as FDIC insurance, that conventional loans offer. Loan interest rates generally differ based on the specific product, and while small business rates are often competitive, crypto lending rates were often exceptionally high, reflecting the higher risk involved.The Mechanics of a Voyager Loan

For users looking to borrow, the "wallet voyager loan" facility would typically involve using their existing crypto holdings as collateral. While the specific terms of Voyager's loan offerings varied, the general principle in crypto lending is to over-collateralize loans to mitigate risk for the lender in a volatile market. For instance, if you wanted to borrow $10,000, you might need to put up $15,000 or $20,000 worth of crypto as collateral. In a broader context of loans, conventional loans often involve a lengthy process with credit checks and offer benefits like FDIC protection for collateral, or a home equity loan allows you to receive a loan using your home as collateral. Crypto loans on platforms like Voyager operated differently. While some general principles of lending might apply, such as the idea that members may only hold one loan at any time, or that if members currently hold two loans, they will be amalgamated into one loan when the member next applies to top up, the underlying risk profiles were vastly different. Some lending services, for example, pride themselves on having no arrangement fees or hidden charges and offer a period to cancel a loan without reason or cost. Users could typically pay back their loan in full online or contact customer service to withdraw funds. While these aspects reflect transparency and user-friendliness in general lending, the core mechanics of crypto loans on platforms like Voyager were tied to the volatile nature of digital assets and the custodial control of the platform.Transaction Speeds and Operational Realities

Initially, the Voyager app was often praised for being user-friendly and very intuitive. It provided a seemingly seamless interface for buying and selling cryptocurrencies. However, beneath the intuitive surface, users began to experience significant operational realities, particularly concerning transaction speeds and the movement of funds. It became apparent that the processes were slower than anything except maybe real estate mortgage escrows. Cleared funds, in any currency, could take weeks for wallet-to-wallet transfers. This created significant frustration, as opportunity costs might be far greater than any benefits provided by the app, especially in a fast-moving crypto market. As one user might have put it, "Voyager is a maybe someday, but not ready today." The reason for these delays lay in Voyager's operational structure. Unlike direct blockchain transactions, user transactions on Voyager didn't go directly to the network. Instead, they had to be approved, reviewed, and meet whatever compliance requirements by Voyager first. That's how Voyager always operated. Only then would the blockchain execute the transfer you requested. Even when Voyager was fully in business years ago, most transfers took a while. This centralized approval process, while intended for security and compliance, significantly impacted user experience and liquidity, a critical factor when dealing with a "wallet voyager loan" or any digital asset.The Collapse: When a Wallet Voyager Loan Turned Sour

The promise of high yields and easy access to a "wallet voyager loan" system came crashing down for many users with the platform's eventual bankruptcy. A major contributing factor to Voyager's downfall was its exposure to large, unsecured loans made to other crypto entities, particularly Three Arrows Capital (3AC). A critical piece of information that emerged during the bankruptcy proceedings was that Alameda Research, a trading firm associated with FTX, owed Voyager approximately $200 million in an outstanding crypto loan, from a line of credit that was worth $377 million before the market downturn. This substantial debt, coupled with other non-performing loans, created a liquidity crisis for Voyager, leading to its declaration of bankruptcy in July 2022. The collapse meant that users lost immediate access to their funds held in their Voyager wallets. The assets that were part of the "wallet voyager loan" system, whether deposited for yield or used as collateral for borrowing, became entangled in complex legal proceedings. Voyager customers' recovery hopes depended largely on the outcome of litigation with FTX, which is seeking to claw back $445.8 million in loan repayments made to Voyager before FTX collapsed into its own bankruptcy. This intricate web of inter-company loans and subsequent collapses highlighted the systemic risks within the crypto lending space, especially for centralized platforms that operated with limited transparency and regulatory oversight.Navigating the Aftermath: Tax Implications and Recovery

The fallout from Voyager's collapse extended beyond just the loss of access to funds; it also created significant headaches for users regarding tax reporting. For those who had engaged in trading or lending activities on the platform, determining capital gains and losses became a complex endeavor. Users were often directed to third-party services like CoinLedger, as Voyager was using them to determine capital gains for tax purposes. While you could view all transactions you made while using Voyager, the suck part was that there was no official tax documentation form to use when you file your taxes. This lack of clear, consolidated tax documentation from the platform itself added another layer of frustration and complexity for users trying to comply with tax regulations, even after their funds were frozen. Users might have been advised to check back in their email for an email from Voyager dated January 29, but clear, ready-to-use tax forms were notably absent. The recovery process for affected users has been protracted and uncertain. Unlike conventional loans, which often come with benefits such as FDIC protection for collateral, crypto assets held on platforms like Voyager had no such federal insurance. Typically, getting approved for a conventional loan is a lengthy process that involves a credit check, but it also comes with established consumer protections. The absence of these safeguards in the crypto lending space meant that users were left to the mercy of bankruptcy court proceedings, where their recovery hopes were tied to the liquidation of Voyager's assets and the outcome of various litigations. The contrast with traditional financial products, where a home equity loan allows you to receive a loan using your home as collateral with clear legal frameworks, underscores the nascent and often unprotected nature of crypto lending.Lessons Learned from the Voyager Experience

The "wallet voyager loan" saga offers profound lessons for anyone participating in or considering the cryptocurrency market, especially concerning centralized lending platforms. 1. **Understanding Custodial Risk:** The most critical lesson is the distinction between holding your own private keys (non-custodial wallet) and entrusting them to a third party (custodial wallet). When Voyager held the private keys to your crypto, your assets were subject to their operational risks, including mismanagement, hacks, or bankruptcy. The mantra "not your keys, not your crypto" became a stark reality for many. 2. **Due Diligence is Paramount:** Before depositing funds into any platform offering high yields or easy loans, thorough due diligence is essential. This includes researching the platform's business model, its transparency, its regulatory compliance (or lack thereof), and its exposure to other entities. High returns often come with commensurately high risks. 3. **Lack of Regulatory Protection:** Unlike traditional banks and financial institutions, which are heavily regulated and often backed by deposit insurance schemes (like FDIC in the U.S.), many crypto lending platforms operated in a regulatory gray area. This meant that in the event of a collapse, users had little recourse for immediate recovery of their funds. 4. **Systemic Risk in Crypto Lending:** The interconnectedness of crypto lending platforms, where one entity's failure (like Three Arrows Capital) could trigger a cascade of insolvencies (like Voyager and later FTX), highlighted the systemic risks inherent in this relatively new financial sector. 5. **Complexity of Crypto Tax Reporting:** The challenges users faced in obtaining clear tax documentation from Voyager underscore the need for better tools and clearer guidance in crypto tax reporting. Users must be proactive in tracking their transactions. These lessons emphasize the importance of adopting a highly cautious approach, adhering to principles of expertise, authoritativeness, and trustworthiness (E-E-A-T) when evaluating crypto services, especially those dealing with "Your Money or Your Life" (YMYL) financial decisions.Future of Crypto Lending and Wallet Security

Despite the setbacks caused by the collapse of platforms like Voyager, the underlying demand for crypto lending and borrowing solutions persists. The future of this space is likely to evolve in several directions, with a stronger emphasis on decentralization and enhanced security. Decentralized Finance (DeFi) platforms offer an alternative to centralized lending, operating on smart contracts that automate lending and borrowing without the need for a central intermediary. While DeFi has its own set of risks (e.g., smart contract bugs, impermanent loss), it addresses the custodial risk inherent in centralized platforms, as users typically retain control of their private keys. The evolution of digital wallets will also continue. We'll likely see more robust self-custody solutions, more intuitive interfaces for managing private keys, and greater integration between non-custodial wallets and decentralized applications. The goal will be to combine the user-friendliness that centralized apps like Voyager initially offered with the security and control of self-custody. Furthermore, regulatory frameworks are slowly catching up, which may provide more clarity and protection for users in the future, though this remains a work in progress. The experience with the "wallet voyager loan" has served as a painful but invaluable lesson, shaping the trajectory of how crypto assets are lent, borrowed, and secured moving forward.Conclusion

The journey through the "wallet voyager loan" experience offers a compelling narrative of innovation, opportunity, and ultimately, significant risk within the nascent world of cryptocurrency. From the initial appeal of a user-friendly app and attractive yields to the harsh realities of slow transactions, custodial risk, and eventual bankruptcy, Voyager's story serves as a critical case study for anyone engaging with digital assets. It underscores the fundamental importance of understanding where your digital assets are truly held, the difference between custodial and non-custodial wallets, and the profound implications of entrusting your funds to centralized entities without adequate regulatory safeguards. While the promise of crypto lending remains, the lessons learned from Voyager's collapse emphasize the need for rigorous due diligence, a clear understanding of risk, and a cautious approach to navigating this evolving financial frontier. What are your thoughts on the future of crypto lending after the Voyager experience? Share your insights in the comments below, or explore other articles on our site to deepen your understanding of digital asset security and investment strategies.- Breckie Hill Leaked Video

- Sophie Rain

- Sophie Rain Onlyfans Leak Exploring The Facts Myths And Controversies

- John Mcphee Shrek

- Madison Beer Leak

Slim Bifold Wallets For Men RFID - Front Pocket Leather Small Mens

Leather Coin Pocket Wallet | Handmade Original Design by JooJoobs

Slim Leather Bifold Wallets For Men - Minimalist Small Thin Mens Wallet